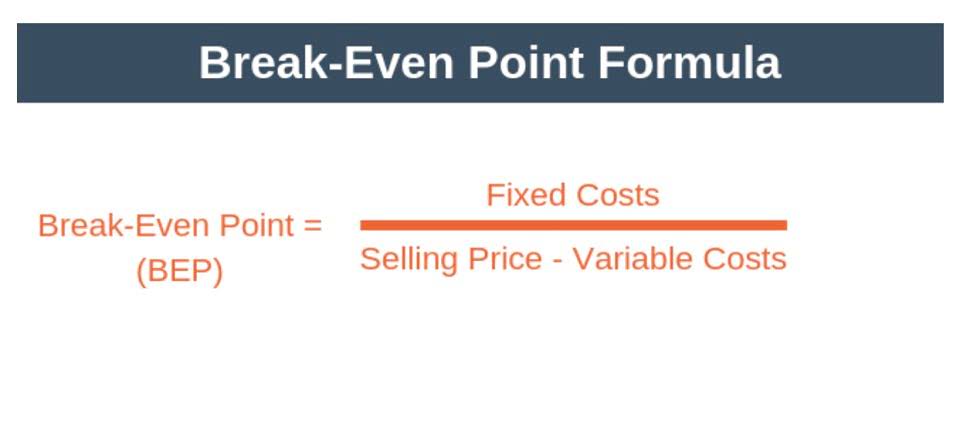

The unit cost or breakeven point is the minimum amount of price at which a company should sell their product to avoid losses. For example salaries of employees involving directly in production, cost of direct material, packaging cost, and cost of shipment or delivery. As the formula for production cost is a simple addition operation, we can use a simple formula to calculate it. Normally, price of a product is set above its ATC, so that some profit can be made from the sale of the product.

Conversion Costs: Definition, Formula, and Example

In manufacturing, obvious production expenses include raw materials, production labor costs, production equipment and the lease of manufacturing facilities. As the Complete Controller mentions, this can also include insurance, depreciation and even stolen assets. In the service industry, the production costs can include material costs of delivering the service and labor costs paid to provide that service. Analysing total production costs helps you identify areas where costs can be controlled and optimised.

Significance of Cost per Unit

Read all the important terms related to the cost of production and also about its importance. Here’s a simplified template that we’ll use to determine the cost per unit of a product. Cost unit is the base unit that is required for buying the least amount of a given product where as unit cost is the least cost per unit cost of production formula to purchase a unit of a product. WareIQ is backed by leading global investors including Y Combinator, Funders Club, Flexport, Pioneer Fund, Soma Capital, and Emles Venture Partner. Calculating cost per unit is important because it is a key determinant of net profit per unit or earnings per share (EPS).

How TopBuxus 10x’d Sales Volume in Just 4 Months with ShipBob [Case Study]

- The 1,200 ending work in process units are only 35% complete with regard to conversion costs and represent 420 (1,200 × 35%) equivalent units.

- This means that the costs remain unchanged even when there is zero production or when the business has reached its maximum production capacity.

- Consider a scenario where a company manufactures 400 units of a product within a month.

- This U-shape of the ATC curve is due to the law of diminishing marginal returns, which operates in the short run.

- By knowing the exact cost of production, you can make informed decisions regarding pricing, resource allocation, and operational workflows to improve your margins and manufacturing efficiency.

Total fixed costs remain the same, no matter how many units are produced in a time period. As the Corporate Finance Institute points out, if production goes to zero, any costs you have remaining are fixed costs. Manufacturing inventory management software is an automated system that can improve inventory visibility, accuracy, and control to reduce production costs and increase productivity. In managerial accounting fixed costs are normally irreverentas the entity has no control over it.

Implementing strategies to optimize your business’s logistics and supply chain processes can help reduce the average production costs. In contrast, fixed costs stay the same regardless of sales or production volume. Examples of fixed costs include property taxes, insurance premiums, asset depreciation, salaries, and other consistent expenses. Variable expenses vary depending on the volume of production or sales. Examples include raw materials, shipping costs, commissions, and other expenses that vary with activity levels.

- Reducing inventory holding costs can be done by optimizing the inventory levels and selling off excess inventory.

- This report shows the costs used in the preparation of a product, including the cost per unit for materials and conversion costs, and the amount of work in process and finished goods inventory.

- Also, ordering only the necessary direct materials for production is important.

- It costs Greg’s biggest competitor $8 on average to create a similar candle.

- Here’s an example of how the cost of production might look for a business.

- In order to calculate cost per unit, the first step is to ascertain operational profitability.

Furthermore, real-time route tracking enables you to track your delivery drivers’ progress. That helps to make necessary route adjustments for on-time arrivals. It also allows you to mitigate the expensive risk of failed deliveries. This results in reduced idle time and less wasted fuel, leading to long-term cost savings. A method to lower these costs is by leveraging eLogii to optimize delivery routes.

Reshipments can also be costly, as they involve shipping the product to the customer again after it was initially returned. Dead stock can be costly for businesses, as they have to pay for the cost of storing it, as well as the cost of eventually disposing of it. Cost per unit plays a crucial role in the day-to-day business operations. Understanding the cost per unit is essential to determine the optimal selling price, gross profit margins, and profitability metrics. Moreover, monitoring the cost per unit over time provides valuable insights into trends and allows for a real-time analysis of costs and revenue.